Types of Personal Loans: A Detailed Guide

Key Takeaways:

- Personal loans are common lending options in India, with over 67% of them choosing them to meet temporary financial setbacks.

- While there are 8 types of personal loans, loans against mutual funds offer the most flexible repayment options with lower interest rates.

- Joint loans are popular lending options, especially amongst couples where one co-signer has a poor credit score.

- The interest rates of fixed-rate loans are predictable, meanwhile, the interest rate on variable loans fluctuates with the market and economic conditions.

Personal loans are some of the most convenient lending options to meet temporary financial setbacks.

Whether you want to consolidate debt or finance a dream wedding, a personal loan can help you secure funds with flexible repayment solutions.

67% of Indians rely on personal loans to meet their financial needs.

But with so many different types of personal loans available, choosing the right one can be confusing.

Thus, opt for a personal loan whose features align with your needs.

So, let’s get a detailed understanding of the 8 popular types of personal loans.

Personal Loans for Beginners

A personal loan is money borrowed from a lender to meet a specific financial need.

The good thing about personal loans is that there are no usage restrictions.

Some of the common reasons why people opt for personal loans are:

- Home Renovation

- To settle medical bills

- Finance a wedding

- To consolidate debt

- For travel

- Finance a funeral

- To meet moving expenses

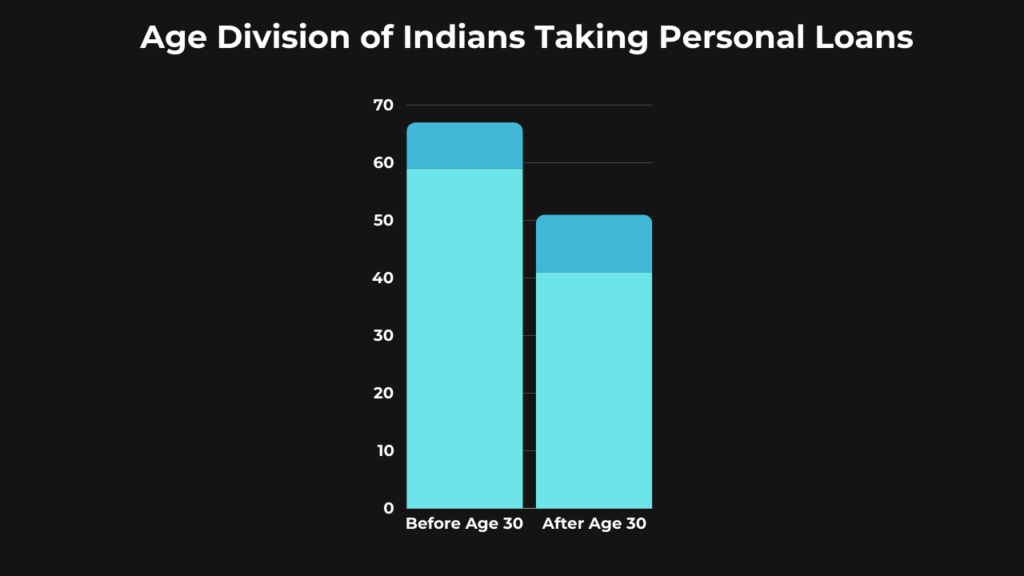

According to a recent RBI report, 59% of Indians who opt for a loan are below the age of 30 and mostly belong to semi-urban and rural areas.

Because getting a personal loan is relatively easy, it has become a popular lending option in India with 14% of women leveraging it.

68% of Indians go for small-value personal loans with the amount going as low as INR 5000.

This proves the versatility and accessibility of personal loans in India.

You can secure a personal loan from banks or any other financial institution.

The amount of money you borrow is repaid in installments with interest. Sometimes, lenders charge a processing fee as well.

With the availability of several digital lending options and same-day amount disbursement, securing a personal loan has become a breeze.

8 Common Types of Personal Loans

Getting a personal loan is easy but choosing the most suitable option from the lot can be challenging.

Therefore, make sure you analyze every aspect of the type of personal loan you select.

1. Loan Against Mutual Funds

Key Features:

- 100% Digital

- No Minimum CBIL Required

- 4 Working Hour Disbursal

This is a rather unconventional approach but a neat option open to people with mutual fund investments.

You use your mutual fund units as collateral to get immediate access to funds.

The amount of the loan depends on the value of your asset.

The great thing about mutual fund loans is that you don’t have to liquidate your investments.

Instead, you continue to earn profit from your investments while meeting temporary cash-strapped situations.

With 50Fin, you can secure a loan against a mutual fund in four simple steps, with interest as low as 10.5% per annum!

Anybody between the ages of 18 and 65 can go for this lending option, making it super accessible.

2. Salary Advance Loans

Key Features:

- Flexible repayment options

- Quick Disbursal

- No Collateral

Sometimes FD withdrawals are not enough to cover unexpected financial crunches.

The next best option is to opt for a salary advance loan from your current employer – an ideal way to cover your urgent financial needs without going through time-consuming and mentally draining bank visits.

While one has to pay interest on short-term salary advances, other terms and conditions vary from lender to lender.

You have the option to repay money before your next salary or you can take your time and repay the amount in installments.

Best Salary Advance Loans in India:

- PaySense: Loan amount from 5000 INR to 5 Lakh INR

- LoanTap: Loan Amount up to 2.5% of your net salary

Salary advance loans come with a host of advantages, like no collateral, quick disbursement, and a flexible repayment schedule.

3. Unsecured Loans

Features of unsecured loans:

- Has an established market in India already

- Approved on the borrower’s creditworthiness

- Offers flexible repayment options

Unsecured loans are unique lending options with an established market in India.

They are approved on the borrower’s creditworthiness and are used to meet various financial needs.

If you are looking for a hassle-free approach to securing a personal loan, this one might be it for you.

Offering flexible repayment options and absolutely no collateral as a guarantee, this loan is one of the most popular types of loan on this list.

The application process for an unsecured loan might take a couple of days but once they’re approved, the amount is disbursed within 24 to 48 hours.

4. Buy Now, Pay Later

Key Features:

- Best for Temporary Cash Shortages

- Tenure Lasts for 6 weeks

- Installment Option Available

Buy now, pay later is a common digital lending option that solves several financial hurdles.

For example, if you want to buy something fancy or require urgent cash for car repair, BNPL loans can be your quick solution.

Now here’s how they work: You opt for the loan to buy something, avoiding total upfront charges. Instead, the amount is divided so you can pay it later in installments.

Usually, the repayment tenure lasts for six weeks after the purchase.

Common BNPL options include:

- Afterpay

- Affirm

While it is normal to overspend sometimes, taking a BNPL loan might not always be in your best interest as it directly impacts your credit score.

5. Debt Consolidation Loans

Key Features:

- Affordable Interest Rates

- Faster Debt Consolidation

- Higher Origination Fee

Debt consolidation loans are ideal if you’re burdened by the hefty interest of other loans.

Basically, you can leverage a debt consolidation loan to pay off a debt faster, one that’s been draining all your hard-earned money.

So when you borrow this loan, you don’t become interest-free entirely, however, the installments become manageable.

This loan will pay off the balance on the primary loan while the interest on these loans is far more flexible with longer tenure.

Apps for Debt Consolidation | Best For |

Upgrade | Flexible repayment option |

Lending Point | Fast loan approval |

Avant Personal Loan | Low origination fees |

Upstart | Borrowers with no credit history |

Debt consolidation loan has an origination fee that might be slightly higher but it helps you avoid getting into the quicksand of debts.

6. Fixed Rate Loans

Key Features:

- Predictable Interest Rates

- Budget-friendly

- Stress-free

If you’re looking for a loan that has fixed interest rates throughout the loan tenure, this is the one for you.

A fixed-rate loan gives you clarity – you know the interest rate throughout the repayment tenure.

This way, planning your finances becomes easy. With fixed-rate loans monthly income budget becomes seamless and stress-free.

7. Joint Loans

Key Features:

- Equal EMI Division

- Requires Co-Signer

- Established Market in India

There are times when you may not qualify for a loan. It could be due to your inability to support yourself or low creditworthiness.

This is when a joint loan becomes your silver lining.

In most cases, couples opt for this solution to renovate their home or buy a car.

To get a joint loan approved, your co-signer should have a good credit score.

And because the loan is getting approved due to their creditworthiness, the responsibility to repay the amount is equally divided between you and your co-signer.

But should you default, their creditworthiness will also decrease.

8. Variable Loans

Key Features:

- Volatile and fluctuating rates

- Interest Rates May Rise with Time

- Problem While Budgeting

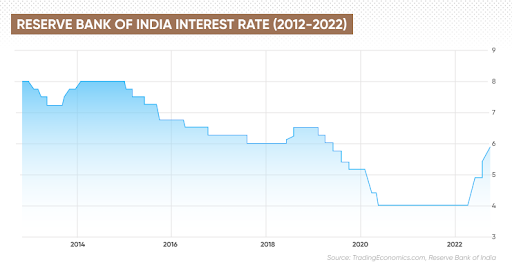

Variable loans are the opposite of fixed-rate loans.

While fixed-rate loans allow you to budget and plan your finances, variable loans are rather volatile, keeping you on your toes.

Here, the interest rates fluctuate with the market conditions.

This makes budgeting your finances a bit challenging as you never know when the interest rates will rise.

Why You Should Take A Personal Loan – Our Opinion

The decision to take a personal loan should solely be based on your financial situation.

Taking a loan is easy, but ideally, one should also be in a position to repay the loan with interest.

This is why it is compulsory to evaluate your current and future financial prospects.

Ask yourself if you earn enough to support your monthly finances while having enough left to pay your EMIs.

Moreover, the circumstances vary from person to person – for example, if you have a medical emergency, you are not going to think about the future, you would rather take care of this pressing need first.

Now what type of personal loan you take depends on your needs.

Loans against mutual funds are a quick, short-term solution.

This one allows you to secure immediate funds without disturbing long-term financial plans.

But again, if your credit score is poor, a joint loan becomes a top contender.

The Bottom Line

While there are different types of personal loans available, a loan against mutual funds is the most secure with flexible repayment options and affordable interest rates.

So, should you decide to opt for a personal loan against mutual funds, make sure to check in with 50Fin.

At 50Fin, you can get your loan approved within 7 minutes!

Sign up at 50Fin to confirm your eligibility now!

Get FREE Eligibility Report

Instantly check your eligibility for Loan Against Mutual Funds

- No Minimum CIBIL Required

- 100% Digital

- 4 Working hour disbursal

Looking for Loan Against Stocks?

Recent Articles

This comprehensive guide covers everything you need to know about loans against mutual funds in India, including benefits, eligibility criteria, interest rates, risks, the application process, and frequently asked questions.

This guide provides a comprehensive view of NSE and BSE stock market holidays for 2025, highlighting opportunities for long weekends and essential details for every trader. Use this resource to check if the Indian stock market is open today, plan for share market holidays tomorrow, or get insights into market closures throughout the year.

For Indian investors and borrowers, understanding ECS return charges and learning how to avoid them is crucial. This comprehensive guide covers everything you need to know