How to Choose The Right Type of Personal Loan: A Guide

Personal loans have successfully gathered a reputation as quick and stable tools for financial requirements.

From weddings to emergencies, the issuance of types of loans has already increased by 30.94% in March 2024 in India.

But with the number of options available in the Indian market, starting from loan against mutual funds, how can you choose the best option possible?

Well, here’s a detailed guide.

An overview

A personal loan is an unsecured loan, meaning you don’t need to provide any collateral or security to the lender.

The flexibility and ease of obtaining personal loans make them an appealing option for most Indians.

However, with multiple lenders, loan types, interest rates, and features available choosing the right type of personal loan can be confusing, especially in India.

It’s a versatile loan that can be used for a wide range of purposes, including:

– Medical expenses

– Wedding costs

– Home renovations

– Education expenses

– Debt consolidation

– Travel or vacations

Since personal loans are unsecured, they usually come with higher interest rates compared to secured loans like home or car loans.

Therefore, it is important to choose the right type of personal loan to ensure that you don’t end up paying exorbitant interest or face financial strain during repayment.

How to choose the right type of personal loan?

1. Evaluate your needs

Question #1: Why do you need a loan in the first place? This helps you narrow down your search to a specific type of loan.

This question is then followed by:

- How much money do you require?

- What kind of interest rate would be feasible for you?

- What will be the repayment frequency like?

Different types of personal loans cater to various needs, so it’s important to align the loan type with your financial goals.

Here are some common reasons people take personal loans:

- Medical Emergency: If you need immediate funds for medical treatment, look for a loan with a fast approval and disbursal process.

- Debt Consolidation: You may be looking to consolidate multiple debts into one. In this case, find a personal loan with a lower interest rate than your existing debts.

- Wedding or Vacation: These types of loans may not require urgent funds but could benefit from a longer repayment tenure.

2. Compare interest rates

Interest rates play a significant role in determining the overall cost of your large or small personal loan.

The interest rate charged on personal loans in India typically ranges between 10% and 24%, depending on your credit score, income, and the lender’s policies.

So how can you get the best kind of interest rate?

Credit Score: Borrowers with high credit scores (700 and above) can often negotiate lower interest rates, while those with low scores might face higher rates. In certain cases, you can also borrow a personal loan without a CIBIL score.

Loan Amount and Tenure: Shorter loan tenures tend to have lower interest rates, while longer tenures may attract higher rates.

Employment Status: Salaried employees with stable jobs often receive lower rates than self-employed individuals, as the latter group is considered higher-risk by lenders.

It’s advisable to shop around and compare interest rates across multiple lenders, including banks, NBFCs, and digital lending platforms, to ensure you get the best deal.

3. Check your eligibility

Each lending institution will have eligibility criteria that you’d have to meet.

Before applying for a personal loan, you need to check the eligibility criteria of various lenders.

While eligibility criteria can vary from one lender to another, here are the common factors considered:

- Age: Most lenders in India require the borrower to be between 21 and 60 years of age.

- Income: Lenders will look at your monthly income to determine your ability to repay the loan. Minimum salary requirements can vary, but generally, it ranges from ₹15,000 to ₹25,000 per month.

- Employment Status: Salaried employees, especially those working with reputed companies, may have better chances of approval. Self-employed individuals may have to provide additional documentation to prove their income stability.

- Credit Score: Most lenders in India prefer a credit score above 700, but some may approve loans with lower scores at higher interest rates.

Ensure that you meet the eligibility criteria before applying to avoid rejection, which can negatively impact your credit score.

4. Choosing the loan tenure

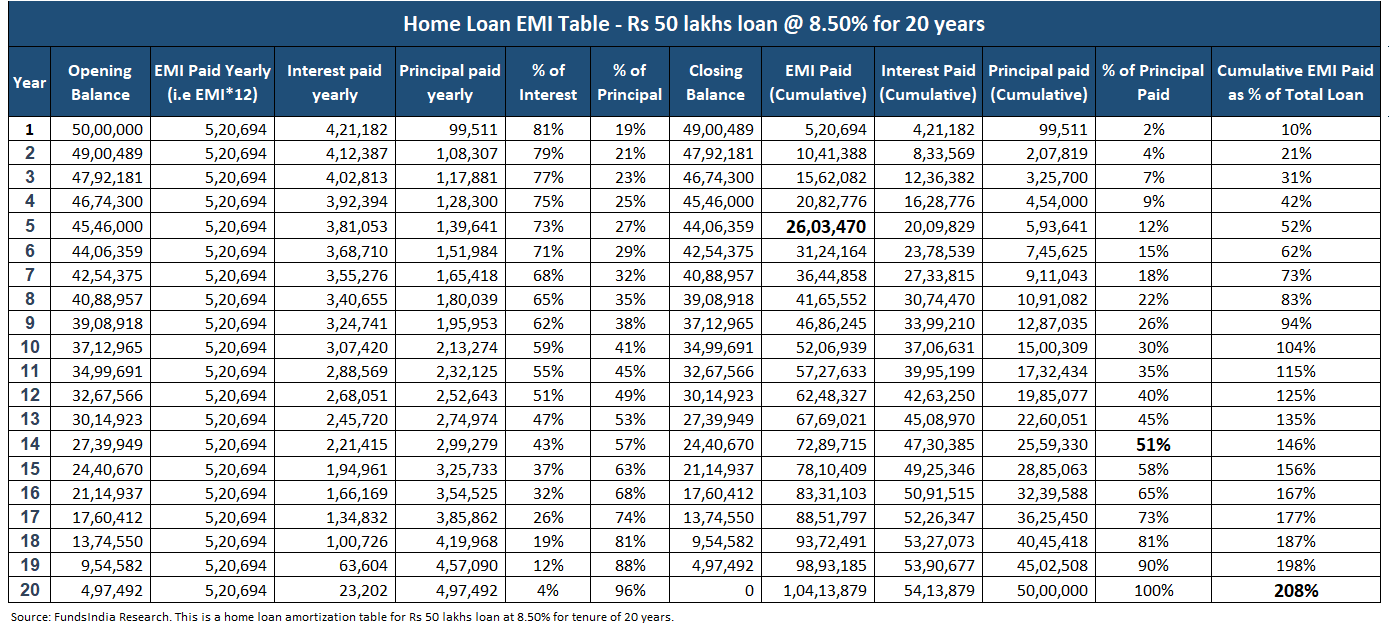

Personal loans typically offer flexible repayment tenures, usually ranging from 1 year to 5 years.

While a longer tenure reduces your monthly EMI, it increases the total interest cost over the loan term.

Conversely, shorter tenures result in higher EMIs but lower total interest costs.

Here’s an example of the loan tenure for a home loan in India:

So how do you evaluate the loan tenure?

Long Tenure: Suitable if you want lower monthly EMIs but are comfortable with paying more in interest over time. This is useful when you have other financial obligations and want to keep your monthly payments low.

Short Tenure: Choose a shorter tenure if you can afford higher EMIs, as it will save you money on interest in the long run.

5. Evaluate Fees and Charges

When choosing a personal loan, many borrowers focus solely on interest rates and ignore other associated fees and charges.

However, these fees can significantly increase the overall cost of the loan. Common fees and charges include:

- Processing Fees: Lenders charge a processing fee to cover administrative costs. This fee usually ranges between 1% and 2% of the loan amount.

- Prepayment and Foreclosure Charges: Some lenders impose penalties if you repay the loan before the end of the tenure. Make sure to check whether your lender charges these fees, especially if you plan to repay the loan early.

- Late Payment Fees: If you miss an EMI payment, you may be charged a late payment penalty, which can further increase your financial burden.

Read the loan agreement carefully and understand all applicable fees and charges before signing the contract.

6. Check the Lender’s Reputation

Analyzing the reputation of the lender is one of the most important responsibilities that a borrower has to fulfill.

Ensure that the lender is transparent about all terms and conditions and has a good track record in handling personal loans.

You don’t want to be borrowing loans from institutions or parties that will change the terms of the loan after a certain period of time without letting you know.

Research the lender’s reputation by:

- Reading Customer Reviews: Check online reviews and ratings from previous customers to gauge the lender’s reliability and customer service.

- Asking for Recommendations: Seek advice from friends, family, or financial advisors who have experience with personal loans.

- Visiting Branches: If you prefer working with a traditional bank, visit the branch to assess their customer service and willingness to answer your questions.

7. Calculate Your EMI

Before taking out a personal loan, use an online EMI calculator to estimate your monthly payments.

This will help you understand whether the loan is affordable and fits within your budget.

Ensure that your EMI payments don’t exceed 30-40% of your monthly income to avoid financial strain.

- Input the loan amount, interest rate, and tenure into the calculator.

- Review the monthly EMI result and assess whether you can comfortably manage the payments alongside your other financial obligations.

Most banks and financial institutions provide online EMI calculators to help potential borrowers make informed decisions.

Choosing the right type of personal loan

Choosing the right type of personal loan in India requires a careful assessment of your financial needs, eligibility, interest rates, and loan terms.

The different types of personal loans will allow you to find the best option that meets your budget requirements.

However, if you’re already an investor, we’d like you to know that there are also options like borrowing against your mutual funds.

And 50Fin allows you to do that.

Sign up now and witness a 7-minute approval time and a 4 working-hour disbursal time of your funds.

Get FREE Eligibility Report

Instantly check your eligibility for Loan Against Mutual Funds

- No Minimum CIBIL Required

- 100% Digital

- 4 Working hour disbursal

Looking for Loan Against Stocks?

Recent Articles

This comprehensive guide covers everything you need to know about loans against mutual funds in India, including benefits, eligibility criteria, interest rates, risks, the application process, and frequently asked questions.

This guide provides a comprehensive view of NSE and BSE stock market holidays for 2025, highlighting opportunities for long weekends and essential details for every trader. Use this resource to check if the Indian stock market is open today, plan for share market holidays tomorrow, or get insights into market closures throughout the year.

For Indian investors and borrowers, understanding ECS return charges and learning how to avoid them is crucial. This comprehensive guide covers everything you need to know