Loan Against Mutual Funds Vs Gold Loans: A Detailed Comparison

Key Takeaways:

- Loans against mutual funds are an ideal online lending option for meeting short-term cash-strapped situations without dissolving long-term financial plans.

- If you opt for a gold loan, you must repay the amount within 24 months. But if you choose to borrow a loan against your mutual fund units, you can benefit from flexible repayment schedules, predetermined by both you and your lender.

- Loans against mutual funds allow you to continue benefiting from returns from your investments, making it an ideal option for investors.

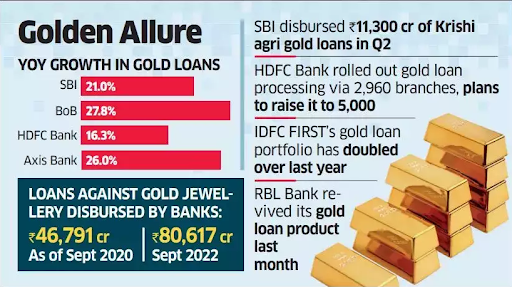

Gold loans are still one of the most popular types of loans across India.

A report by The Economic Times is a testament to that.

But when you look beyond gold loans, you’ll find diverse lending options.

One of them is loans against mutual funds.

Gold loans and loans against mutual funds are popular options to meet short-term and long-term financial needs.

While gold loans are quite traditional in their terms and conditions, loans against mutual funds are rather unconventional and unique – allowing you to continue earning profit from your investments and enjoy flexible repayment schedules.

So what option is the best for you?

Let’s evaluate that in detail.

A Beginner’s Guide to Loans Against Mutual Funds

While gold and home loans are known lending options, borrowing a loan against your mutual fund investments is a fairly new avenue.

But what exactly are mutual fund loans?

Technically, these are loans where you pledge your mutual fund investments as collateral to a financial institution, making it a unique arrangement that gives you immediate access to funds without dissolving your investment.

This makes loans against mutual funds the ultimate option for meeting short-term financial crunches without ending long-term investments.

Mutual fund loans are secure with comparatively lower interest rates (typically ranging from 10 to 13% per annum) and flexible payment schedules.

There are no usage restrictions as such so you can utilize them for various reasons, such as:

- To pay for medical bills

- To support your education

- To earn professional certifications

- To repair your car

- For home renovations

When you pledge against your mutual fund investments, your portfolio goes into a lock-in period till you repay your loan amount.

However, you can continue to earn dividends from your mutual fund investments.

The 101s of Gold loans

The concept of gold loans is pretty common.

To access funds, you pledge your gold to a financial institution.

Just like you can borrow against your home or property, gold loans allow you to borrow money using gold as collateral.

Gold loans are a much more secure option for a bank and any other lender because it frees them from the worry of non-performing assets.

In this case, if you borrow against gold and default to repay, the lender can keep your gold to redeem the money.

It is important to consider gold processing fees. Some lenders charge a gold processing fee, ranging between 1 to 3% of the total loan amount.

An In-depth Analysis of Gold Loans and Loans Against Mutual Funds

The mutual fund market is constantly growing in India, setting new records with every passing year. For example, it surpassed INR 50-lakh crore last year, hitting a new milestone for the industry.

While gold loans are common, the raging popularity gives borrowing loans against mutual funds an upper hand.

Let’s consider the common features of both lending options in detail.

1. Interest Rate

The interest rate on gold varies and depends on the purity of the gold you’re pleading against.

While the interest rates in the public sector go as high as 18% per annum, the private sector charges 24% per annum.

On the other hand, the interest rates for loans against mutual funds are much lower, ranging between 10.5% and 14% per annum.

In fact, 50Fin can help you secure loans against mutual funds at only 10.5% interest rate.

2. Loan Amount

The loan-to-value ratio for gold loans ranges between 55% to 65%. This means that the bank keeps a 35 to 45 percent profit margin, making it an ideal option for them.

Let us explain this LTV concept to you with the help of an example.

Suppose you’re pledging a loan against your gold worth INR 10,000. Now the current loan-to-value ratio is 65%, implying that you can get a loan of INR 6,500 INR.

In comparison, when you opt for a loan against mutual funds, your loan amount will depend on the value of your mutual fund units.

You can get up to 80% of the Net Asset Value of your mutual fund unit, making it an ideal option for you.

3. Tenure & Payment Schedules

While gold loans can be ideal for meeting temporary cash shortages, mutual funds are even more flexible, due to comparatively longer tenures.

This way, you don’t have to worry about the looming deadline.

Typically, you can secure a loan against gold and repay it within 6 to 24 months.

On the other hand, you have loans against mutual funds where the repayment schedules can be extended, depending on your ability to repay with the lender’s agreement.

On the bright side, with 50Fin, you pay no foreclosure charges.

So, if you repay the loan before the predetermined time, you don’t pay any extra money out of your pocket.

4. Risks

While both gold and loans against mutual funds are secure, the latter gets the upper hand because you get repayment flexibility.

With gold loans, if you fail to repay within 24 months, the lender can redeem the money by selling your gold.

Practically speaking, you’ll see how the value of mutual fund units increases with time, continuing to give you returns.

But when you pledge your gold, it’s no longer in your hands until you repay the loan and win it back.

5. Eligibility Criteria

Because your gold is already in possession of the bank, even someone with a low credit score is also eligible for a gold loan.

The same goes for loans against mutual funds.

The financial institution lending you the money already has access to your mutual fund units, which means they can redeem it should you fail to repay.

Loan Against Mutual Funds Vs Gold Loans – A Quick Overview

Considerations | Loans Against Mutual Funds | Gold Loans |

Interest Rates | 10.5% per annum | 18% to 24% per annum |

Repayment Schedule | Flexible, dependent on lender policies | To be repaid within 24 months |

Credit Score | Flexible, depends on the lender | A low credit score is acceptable |

LTV Ratio | Up to 80% | 65% |

Collateral | Mutual fund units | Gold |

Three Reasons For Choosing Loan Against Mutual Funds

While there are various reasons to opt for a loan against mutual funds, here are the top three reasons we believe a loan against mutual funds will be an ideal option for you.

- You can continue to earn profit while using them as collateral against your loan.

- The process is quick and completely digital. You can secure a loan against mutual funds in 7 minutes with 50Fin!

- The flexibility allows you to meet short-term financial crunches without disturbing long-term investments.

The Bottom Line

While you may opt for gold loans to meet temporary cash-strapped situations, choosing a loan against mutual funds demonstrates superiority due to higher LTV and lower interest rates.

What gives loans against mutual funds an edge is its process – it’s completely digital.

And that’s where the role of 50Fin comes into play.

With 50Fin, you can secure a loan against mutual funds in 4 simple steps.

And the cherry on top? The amount will be deposited into your bank account on the same day.

Impressed? Check your eligibility now!

Get FREE Eligibility Report

Instantly check your eligibility for Loan Against Mutual Funds

- No Minimum CIBIL Required

- 100% Digital

- 4 Working hour disbursal

Looking for Loan Against Stocks?

Recent Articles

This comprehensive guide covers everything you need to know about loans against mutual funds in India, including benefits, eligibility criteria, interest rates, risks, the application process, and frequently asked questions.

This guide provides a comprehensive view of NSE and BSE stock market holidays for 2025, highlighting opportunities for long weekends and essential details for every trader. Use this resource to check if the Indian stock market is open today, plan for share market holidays tomorrow, or get insights into market closures throughout the year.

For Indian investors and borrowers, understanding ECS return charges and learning how to avoid them is crucial. This comprehensive guide covers everything you need to know