Personal Loan vs Mutual Funds Loan: What’s better?

With the number of loan options available right now, it’s not uncommon to feel overwhelmed.

From traditional lending options to online lending, there are plenty of options to evaluate before borrowing a loan.

Out of these options, personal loans, home loans, and mutual funds loans are some options that you can explore.

But how exactly is a personal loan different from a mutual funds loan?

And most importantly, which option is better for you?

Let’s talk about that in detail.

Revisiting Personal Loans

A personal loan is an unsecured loan provided by banks, non-banking financial companies (NBFCs), or online lenders.

Personal loans mostly don’t require any collateral and that means there’s no need for you to pledge any assets.

These types of loans are common for reasons including:

- Weddings

- Vacations

- Renovations

- Debt Consolidation

- Medical Emergencies

Personal loans, in particular, have been soaring in popularity across India.

The overall issuance of personal loans by commercial banks has notably increased, rising from 16.2% to 30.94% since March 2014, and reaching a total of 48.93 lakh crore by December 2023.

Some of the most important features of personal loans include:

- Unsecured Nature: No collateral required.

- Higher Interest Rates: Typically range from 10% to 24% per annum, depending on the borrower’s creditworthiness.

- Flexible Usage: Can be used for a wide range of personal financial needs.

- Shorter Tenure: Generally ranges from 1 to 5 years.

- Quick Processing: Minimal documentation and quick disbursal.

Everything About Mutual Fund Loans

We’ve talked about loans against mutual funds in detail.

Mutual fund loans are an easy option that complements your investment goals.

When you combine investments with borrowing against securities, you can get a financial goal booster.

Loans on mutual funds is a secured loan where you’re pledging your mutual fund units as collateral.

This type of loan is suitable for individuals who have invested significantly in mutual funds and need liquidity without redeeming their investments.

Some of the most important features of mutual fund loans include:

- Secured Nature: Mutual fund units are pledged as collateral.

- Lower Interest Rates: Typically range from 10% to 13% per annum.

- Specific Usage: There are no strict usage restrictions and can be used for a variety of purposes.

- Flexible Tenure: Usually ranges from 1 to 3 years, but can be longer depending on the lender.

A Detailed Comparative Analysis Between Personal & Mutual Fund Loans

1. Interest Rates

A significant difference between personal loans and mutual fund loans is the interest rate that both have to offer.

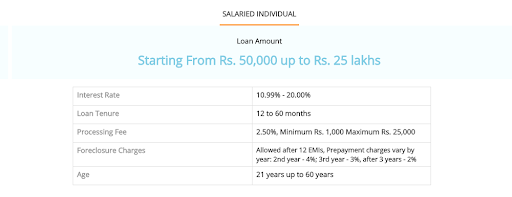

Personal loans tend to have higher interest rates due to their unsecured nature. According to RBI data, personal loan interest rates in India typically range from 10.50% to 24% per annum, depending on the lender and the borrower’s credit score.

On the other hand, loans against mutual funds have lower interest rates, usually between 10% and 13% per annum, as they are secured loans.

Even at 50Fin, we have an interest rate of 10.5% p.a. on mutual fund loans.

2. Loan Amount

Personal loans are of different types, could be from different banks, and could also have different amounts to disburse.

The loan amount for personal loans is generally based on:

- The borrower’s income

- Your credit score

- Repayment capacity

It can range from a few thousand rupees to several lakhs.

For example, most banks across India will offer personal loans up to ₹25 lakhs or even beyond in some cases.

In contrast, the loan amount for loans against mutual funds depends on the value of the pledged mutual fund units.

Typically, lenders offer a loan amount between 50% to 80% of the Net Asset Value (NAV) of your mutual fund units.

For equity mutual funds, the user is eligible for up to 50% of the value.

On the other hand, for debt mutual funds, the user is eligible for up to 80% of the value.

Therefore, if you have mutual fund investments worth ₹10 lakhs, you could potentially get a loan of up to ₹6 lakhs.

3. Tenure

Even though the tenure of your total loan amount is something that you can prepay, you can still expect a tenure of 2 to 7 years for your loan.

This makes them suitable for short-term financial needs or emergencies.

However, a loan foreclosure on a personal loan could also invite extra charges for the borrower.

Now, on the other hand, a mutual fund loan tenure is almost the same as well.

The difference lies in such cases where the loan tenure is extended depending on the lender’s policies and the borrower’s repayment capacity.

The silver lining, however, is that with 50Fin, you’re paying no charges on foreclosing your mutual fund loans.

This is an attractive option for lenders that want to borrow money and pay it back quickly as well.

4. Risk and Collateral

Because of how personal loans are unsecured, there’s usually no risk of losing an asset if you default.

However, this also means:

- Higher interest rates

- Stricter eligibility criteria

- Negative impact on your credit score

On the other hand, however, loans against mutual funds are secured.

This means that your mutual fund units are at risk if you fail to repay the loan.

However, the lower interest rates and potentially higher loan amounts make this a more attractive option if you have significant mutual fund investments.

5. Eligibility Criteria

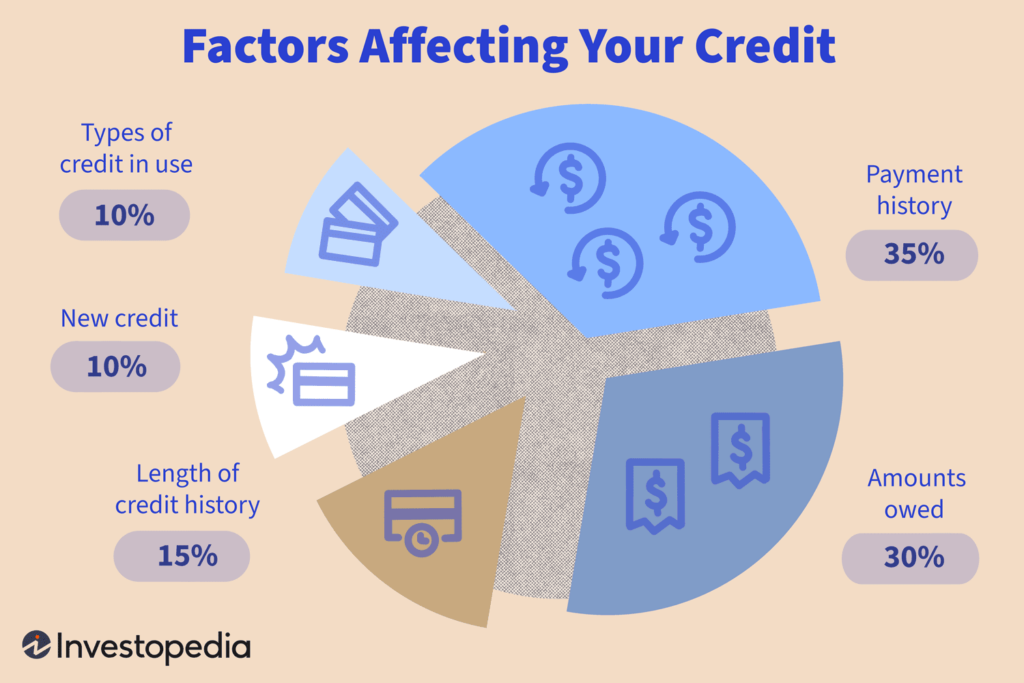

In most cases with most banks, personal loans will require a good credit score as well as a stable income.

The lender assesses the borrower’s repayment capacity based on their income, credit history, and employment status.

A very important consideration is that you’d need a credit score above 750 to be considered for availing of a personal loan at favorable terms.

For loans against mutual funds, the eligibility criteria are more lenient.

Since the loan is secured by the mutual fund units, lenders are less concerned about the borrower’s credit score and income.

However, the value and liquidity of the mutual fund units are crucial factors.

Recommended: Eligibility Criteria For Loans Against Mutual Funds

When to Choose a Personal Loan?

- Urgent Financial Needs: If you need immediate funds, personal loans are ideal due to their quick processing times.

- No Collateral: If you do not have any assets to pledge or do not want to risk losing them, a personal loan is a better option.

- Short-term Requirements: For short-term financial needs, personal loans with their shorter tenures are more suitable.

When to Choose a Loan Against Mutual Funds?

- Lower Interest Rates: If you have mutual fund investments and want to benefit from lower interest rates, this option is preferable.

- Larger Loan Amounts: If you need a larger loan amount and have substantial mutual fund investments, you can get a higher loan amount based on the value of your funds.

- Long-term Financial Planning: If you need immediate funds and quick processing times, loans against mutual funds offer better terms.

Recommended: Pros and Cons of Loan Based on Mutual Funds

Conclusion

Personal loans and loans against mutual funds, both have their own unique set of features that make them an attractive option for investors.

However, with the evolution of digital lending in India, the popularity of mutual fund loans has also soared in popularity.

It’s a great option for borrowers who are looking for lower interest rates and potentially higher loan amounts.

Ultimately, the choice between a personal loan and a loan against mutual funds depends on your financial situation, the urgency of your needs, and your risk tolerance.

If you’d like to get started with mutual fund loans, one of the best ways to do so is by signing up at 50Fin.

At 50fin, you get your loan approved in 7 minutes!

Our solution is tailored to meet your specific loan needs with just a 10.5% interest rate per annum.

Start by signing up at 50Fin to borrow your loan against mutual funds.

Get FREE Eligibility Report

Instantly check your eligibility for Loan Against Mutual Funds

- No Minimum CIBIL Required

- 100% Digital

- 4 Working hour disbursal

Looking for Loan Against Stocks?

Recent Articles

This comprehensive guide covers everything you need to know about loans against mutual funds in India, including benefits, eligibility criteria, interest rates, risks, the application process, and frequently asked questions.

This guide provides a comprehensive view of NSE and BSE stock market holidays for 2025, highlighting opportunities for long weekends and essential details for every trader. Use this resource to check if the Indian stock market is open today, plan for share market holidays tomorrow, or get insights into market closures throughout the year.

For Indian investors and borrowers, understanding ECS return charges and learning how to avoid them is crucial. This comprehensive guide covers everything you need to know