How to borrow a loan against mutual funds online?

Loans often get a bad reputation.

But when managed responsibly, these loans could be a great financial instrument to manage your expenses and keep your finances in check.

Now, of course, loan types have evolved quite a bit over the last few years.

Loans on mutual funds are one of these types of loans.

So how can you borrow a loan on mutual funds? And how good of an idea is it really?

Let’s find out.

Loan Against Mutual Funds (LAMF): Introduction

Mutual fund loans are as simple as they sound.

LAMF means borrowing a loan on your mutual fund units by keeping them as collateral.

In such cases, it’s either a mutual fund lending institution or a non-banking financial company that offers a loan.

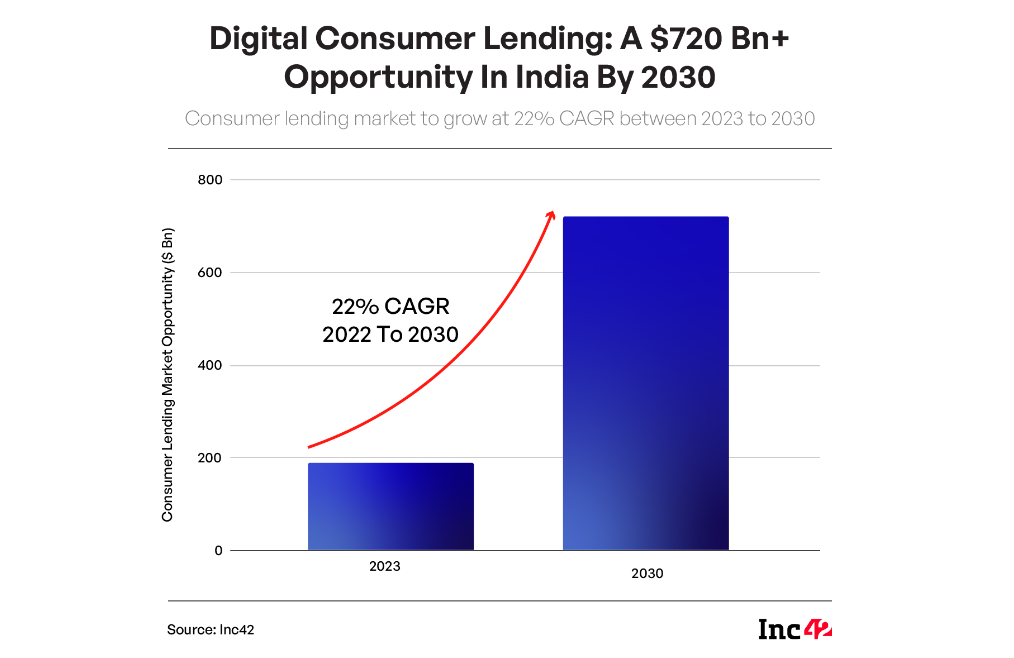

Over the last few years, NBFCs and similar lending institutions have been growing across India. This means that the options for consumers to borrow loans have also expanded.

A report by Inc42 states that the digital lending industry in India is growing beyond $700 billion by 2030.

Such options allow a lot of convenience for people – especially when they want a loan on the go – which is where the option of mutual fund loans also originates from.

Why Borrow a Loan Against Mutual Funds?

Mutual fund loans have a unique set of advantages that make them an ideal option over a traditional loan.

1. Preserving your long-term investment goals

Your investment portfolio is an asset that keeps growing with time. The longer you hold, the more chances you have of building a strong net worth.

Uncertainties may arise from time to time.

But uncertainties don’t last long.

Rather than liquidating your mutual funds portfolio just because you’re in need of money doesn’t sit well with most investors.

Borrowing a loan against your mutual fund’s portfolio means using your MF units as collateral – NOT SELLING THEM.

This means that your portfolio doesn’t need to be liquidated and is able to continue earning returns from the market.

This allows for continued participation in potential market upswings and long-term wealth creation.

2. Quick approval process

Every loan process requires adequate documentation.

But not every documentation has to take you weeks or months just to get approval.

Compared to traditional loan application processes, LAMF often features a quicker and more streamlined approval process, especially when collateral is readily available in the form of mutual fund units.

Since your mutual funds are used as collateral, all the verification is done online only and you’re very likely to get approval on your loan the same day.

Platforms like 50Fin will approve your loan request within 7 minutes and disburse your loan in 4 working hours only.

3. Avoiding market timing risks

If there was a synonym for investments, it would probably be “fluctuations”.

Market fluctuations are common and could affect your short-term and long-term goals.

LAMF will help you to avoid the risks that are associated with market timing decisions. This includes selling assets during unfavorable market conditions or huge market fluctuations.

By using your mutual fund units as collateral, you can also avoid potential losses from mistimed market exits.

4. Potential for higher loan amounts

Your borrowing limit depends on the value of your portfolio.

While most traditional loan types have only a limited threshold, you can easily borrow in accordance with your portfolio value.

Most lenders will allow you to borrow 50-80% of your portfolio value.

Even at 50Fin, you can borrow at least 50% LTV on equity funds.

Borrowers may qualify for higher loan amounts compared to other forms of unsecured borrowing, providing access to more substantial funds for different reasons.

Eligibility Criteria for Loan Against Mutual Funds

Depending on the lending institution, your eligibility for borrowing a loan against mutual funds may vary.

At 50Fin, you need to have a minimum portfolio value of Rs 50,000 to borrow a loan against your mutual fund portfolio.

Here are some more requirements that you need to avail a loan against mutual funds:

- Loan-to-value ratio: The LTV ratio represents the percentage of money that could be borrowed against your mutual fund units. Most lenders will allow you to borrow from ranges between 50% and 80%. For example, if your mutual fund has a value of ₹20 lakhs and the LTV ratio is 50%, you can avail a loan of up to ₹10 lakhs.

- Age Criteria: In India, you need to be at least 18 years old to invest in mutual funds. And since you’re borrowing a loan against your mutual fund units, you need to be at least 18 to be able to borrow a loan.

- Loan Tenure: The loan tenure for loans against mutual funds varies among lenders and may range from a few months to several years. However, you can also foreclose the loan way before time at absolutely zero charges with 50Fin.

- Minimum Value of Units: There is usually a minimum value of mutual fund units required to avail of a loan. Financial institutions may set this threshold based on their risk assessment and lending policies.

Process of Borrowing a Loan Against Mutual Funds

Depending on the platform you choose, the process of borrowing a loan against mutual funds may vary.

The process of obtaining a loan against mutual funds typically involves the following steps:

1. Evaluate Loan Requirements: Determine the purpose of the loan, the amount that you require, and the preferred repayment tenure according to your preferences.

2. Check Eligibility: Most platforms have different kinds of eligibility criteria. As mentioned, you need to have a minimum portfolio of Rs 50,000 to borrow a loan against your mutual funds at 50Fin.

3. Submit Application: After you’ve signed up on your preferred platform, the next step is to complete your application process. Complete the loan application process by submitting the required documents, including your KYC documents.

4. Pledge Your Portfolio: Pledge the required number of mutual fund units in favor of the lender as collateral for the loan. During this period, your mutual fund portfolio will be locked. The units will be lien-marked during the loan tenure.

5. Signing the e-agreement: After you’ve pledged your portfolio, the next step is to acknowledge the terms and conditions of the loan that you’re borrowing.

6. Setting up auto-debit: Auto-debit (or e-mandates) allow the lending institution to debit the money from your checking account every month on a certain date to maintain the repayment schedule.

7. Loan Disbursement: Upon approval, the lender disburses the loan amount to your designated bank account, providing access to the funds for your intended purposes.

Complete Mutual Fund Loan Process With 50Fin

Mutual funds loans have a variety of benefits associated with them which makes them a preferable choice for investors, especially the ones who have the need for money frequently.

It only makes sense to benefit from this type of loan.

And what better way than doing it with 50Fin?

With a loan approval time of just 7 minutes, 50Fin will allow you to borrow a loan against mutual funds without the need for any physical paperwork.

Get FREE Eligibility Report

Instantly check your eligibility for Loan Against Mutual Funds

- No Minimum CIBIL Required

- 100% Digital

- 4 Working hour disbursal

Looking for Loan Against Stocks?

Recent Articles

This comprehensive guide covers everything you need to know about loans against mutual funds in India, including benefits, eligibility criteria, interest rates, risks, the application process, and frequently asked questions.

This guide provides a comprehensive view of NSE and BSE stock market holidays for 2025, highlighting opportunities for long weekends and essential details for every trader. Use this resource to check if the Indian stock market is open today, plan for share market holidays tomorrow, or get insights into market closures throughout the year.

For Indian investors and borrowers, understanding ECS return charges and learning how to avoid them is crucial. This comprehensive guide covers everything you need to know