5 Ways To Maintain A Healthy Mutual Fund Portfolio

Key Insights

- To create an excellent mutual fund portfolio, diversify your investments and strategize a plan that meets your risk tolerance.

- Always review and rebalance your mutual fund investments.

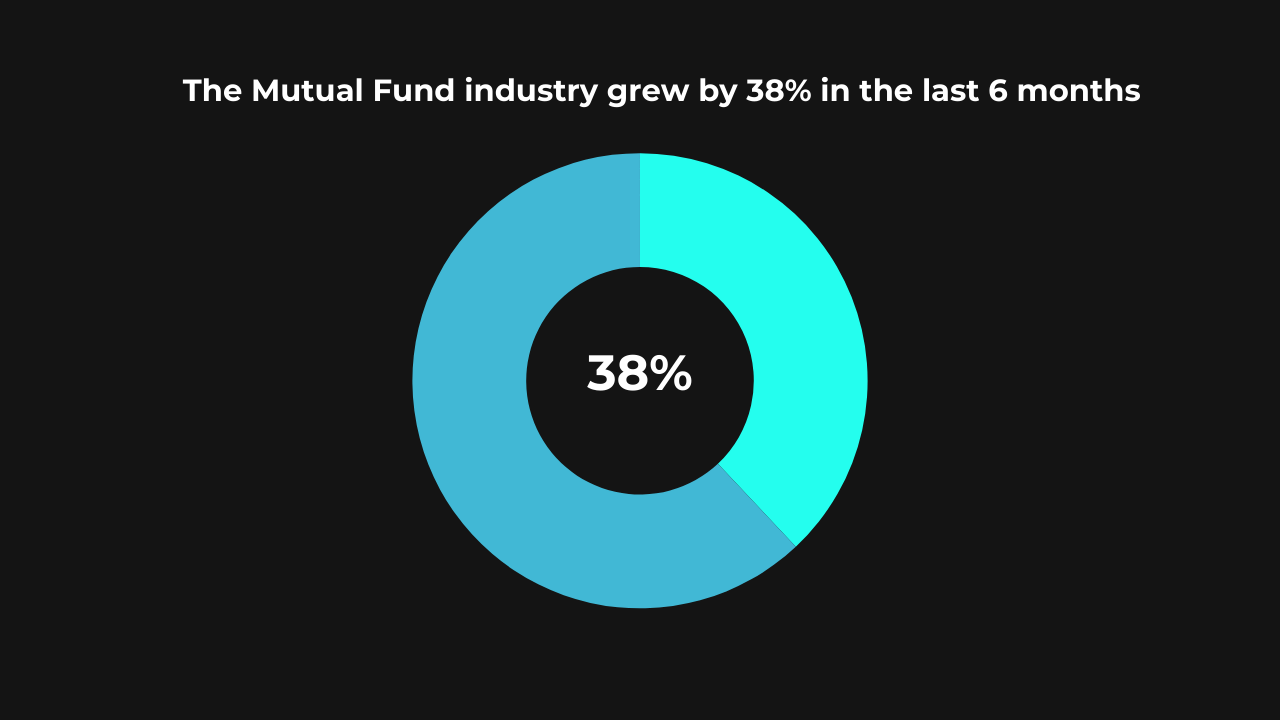

- The mutual fund industry gained immense momentum in the last 6 months, as it crossed 61.16 lakh market share in India.

Whether you are planning for retirement or working towards buying a house of your own, investing in mutual funds is always one of the best ways to come closer to meeting your financial goals.

The beauty of mutual funds is that your investments can be liquidated any time you want.

But to make the most of your investments, you must build a mutual fund portfolio that is diverse with growth potential.

There are so many different ways of building a healthy mutual fund portfolio.

Here’s a detailed guide.

The current scenario of mutual funds

The Indian investment market is rapidly growing and creating new records – almost every month.

For example, the mutual fund industry is expected to surpass INR 100 lakh in the next few years.

It grew by 38% in the last 6 months and has reached 61.16 lakh crore in market share.

Looking at the numbers, mutual fund investments are demanding your attention.

Investing in mutual funds is one of the best ways to secure your money.

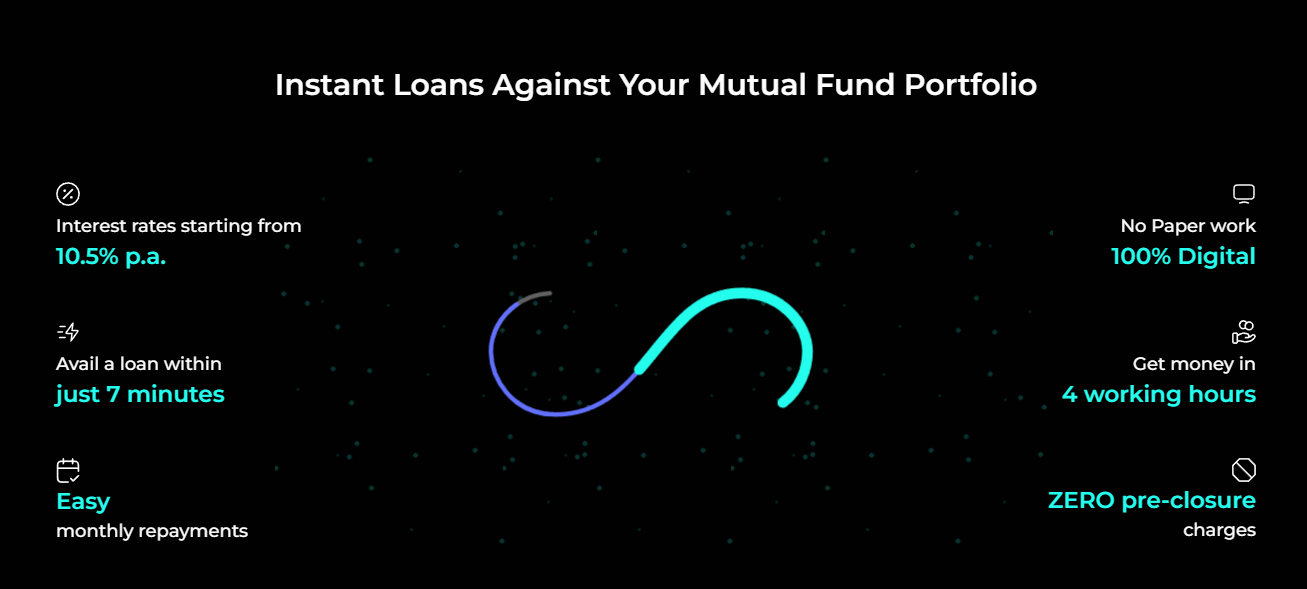

With the growth in mutual funds, it has also become one of the best instruments against which to borrow a loan.

Yes, a loan against mutual funds is one of the best ways to borrow a personal loan currently.

At 50Fin, you can secure a loan against your mutual fund investments within 7 minutes.

And we also get the amount disbursed into your bank account within 4 business hours.

It is a zero-paper work loan that is completely digital.

Key considerations for building a robust mutual fund Portfolio

Building a mutual fund portfolio requires a strategic approach and an ability to gauge market trends and their stability.

You should also have clearly defined goals and investment objectives. Now these goals should be both long-term and short-term.

For instance, it should be your retirement plan as well as your means to finance the next trip to Goa.

The question is: how do you build the right portfolio for yourself? One that meets your financial needs both long and short-term.

The answer is quite simple.

You have to ensure that every mutual fund in your portfolio links with each other in a way that aligns with your one true financial goal.

What is important to consider is your ability to take risks.

The type of mutual funds you will invest in will depend on your risk tolerance.

For example, debt funds are known to be more stable while equity funds are more risky.

5 ways to maintain a healthy mutual fund portfolio

1. Diversify your portfolio

“Don’t put all your eggs in one basket.”

You might have heard this phrase before. And that’s a motto that diminishes your financial risks.

The key to building an excellent mutual fund portfolio is diversification.

What it does is it reduces the stress that comes with putting all your investments in one basket.

The purpose of investing is to expand your options and increase your financial potential. Research bonds and stocks that you feel most comfortable investing in. The more mutual funds you have, the more diverse your portfolio will become.

2. Write and plan your financial goals

The most important thing that you must do before investing in a mutual fund is to get your goals straight. When your foundation is set, you can not only make quicker decisions but also allocate your finances more strategically.

Every person invests for different reasons. Your strategy will take shape according to your objectives.

Do you want to save to meet short-term goals? For example, you are saving to finance your wedding.

OR

Do you want to save for long-term goals? For example, you’re saving for your retirement.

Whatever you decide, look for investment opportunities that align with your goals.

3. Strategize investment tenure

How long are you planning to invest in mutual funds?

If you are keen on investing in mutual funds for 1 to 3 years, debt funds can be a good fit as they are more stable and secure.

But if you are looking into long-term mutual funds with investment tenures ranging somewhere from 7 to 10 years and above, equity funds can be a great investment fit for you.

4. Consider Systematic Investment Plans (SIPs)

Systematic Investment Plans (or SIPs) help you manage and build an excellent mutual fund portfolio.

They are ideal for people with the habit of regular investing.

Here, what you have to do is start small – like any good idea – and then, take one big leap at a time.

The strategy allows you to get comfortable with investments and with more positive experiences, you’ll indulge in more.

5. Review and rebalance

So you have invested in mutual funds. Now what? Well, now the actual work begins.

You have to review how well your mutual funds are performing every year. This annual review allows you to assess how you have positioned your investments.

You can also evaluate whether any fund is overperforming or underperforming. It will give you perspective on where you should invest or reallocate your investments.

3 actionable investment strategies for a balanced mutual fund portfolio

1. Understand your financial plans and balance it with your risk tolerance: You can’t invest in funds that don’t align with your goals. And at the same time, you don’t want to take too high a risk that you’re not comfortable with.

2. Never put your life savings in just one basket: Always have room for diversity. And make sure you constantly evaluate your options. And invest in stocks that you know about. The more knowledge you have, the better outcome you can predict.

3. Get a professional financial advisor on board when needed: A financial advisor will analyze your financial situation and give you the best investment guidance. They would have the experience and tools to understand and predict market conditions for both long and short-term investments.

The Bottom Line

Mutual fund investments can be long-term and short-term.

They give you the flexibility of maintaining a balanced portfolio that meets both your long and short-term financial goals.

But again, you must know how to build a portfolio that aligns with your unique needs and that requires planning and a strategic approach.

By investing in mutual funds, you not only invest for the future, but you leave room for short-term cash liquidation.

And the best way to get a loan against your mutual fund portfolio is by signing up with 50Fin.

We ensure quick disbursement of the amount without spending hours on paperwork. All you’ve to do is sign up.

Get FREE Eligibility Report

Instantly check your eligibility for Loan Against Mutual Funds

- No Minimum CIBIL Required

- 100% Digital

- 4 Working hour disbursal

Looking for Loan Against Stocks?

Recent Articles

This comprehensive guide covers everything you need to know about loans against mutual funds in India, including benefits, eligibility criteria, interest rates, risks, the application process, and frequently asked questions.

This guide provides a comprehensive view of NSE and BSE stock market holidays for 2025, highlighting opportunities for long weekends and essential details for every trader. Use this resource to check if the Indian stock market is open today, plan for share market holidays tomorrow, or get insights into market closures throughout the year.

For Indian investors and borrowers, understanding ECS return charges and learning how to avoid them is crucial. This comprehensive guide covers everything you need to know